Step by Step: How We Retired in Our 30s

Free at 40? We Did It by 33 — The numbers, timeline and story of how we made it work.

It was the title of a random finance book shoved into the stacks of our local library that snagged my husband’s attention.

Titled Free at 45, it promised to illuminate the world of early retirement.

Retire early? That wasn’t even in our awareness when we borrowed this book from the library in early 2021.

Forty-five, hey? Something about it stuck.

But it wasn’t until this idea collided with the concept of investing for cash flow in Spring of 2021 that our first, big, BIG vision was born.

We wanted to be free at 40.

It was the whisper of an idea that turned into a movement within our household that flipped everything we envisioned for our future on its head.

As two “kids” in our early 30s, we set the goal: we wanted to be completely financially independent by the age of 40 and have the option not to work.

Now (spoiler!), if you’ve followed The Freedom Diaries for long, you’ll know we hit it by 33 years old and have scaled up our vision since.

But today, I want to share with you the timeline, the numbers and our story of how we made it work.

Sometimes hearing the end result of a story like ours can feel out of reach or unrealistic, but the goal of this diary is to break it all down so you can see how many baby steps we took to reach early retirement in our mid 30s.

We Decided to Make Money in 2017

This is where we’ll start our story.

Flynn and I had been dating for 2 years and we were getting ready to move in together that Fall.

I lived in a townhouse I bought in 2015 on my own in a fast developing neighbourhood and had about $30,000 in mutual funds at the bank.

Flynn had just finished wiping out his $15,000 line of credit of consumer debt and we were ready to make some money.

In July 2017, we attended a Tony Robbins event and this was the epicentre of our first big money move.

Phil Town was a guest speaker at the event and had this whole program that was all about stock investing.

We had already been exploring the idea of owning rental units, but it was this day we made the decision.

Would we make money in the stock market? Or with real estate investments?

With practically zero knowledge of how the stock market worked, we decided rental properties were our ticket to freedom.

That winter, we went to work learning as much as we could about owning investment properties and cash flowing them.

On May 4, 2018, we bought our first “door”for $315,000 with a $60,000 down payment.

It was a cute, studio apartment that we repainted, cleaned and readied for a renter.

We each put in $15,000 from our savings and borrowed the remaining $30,000 from my parents at a 2% interest rate.

I remember this felt like a HUGE amount of money.

By June 1, we had our first tenants in place, a lovely couple arriving on a Visa from Australia.

We rented our first place for $1,249 per month and were in business.

Our original goal was to accumulate enough rental properties to gross $10,000 per month.

With that as the goal, we went to work over the next 2 years to build our cash to buy more properties.

Going forward, I’m going to present to you a simplified but accurate timeline of how our dream evolved.

2020: A Jump into the Market

FEBRUARY

We welcomed our first baby to the world only weeks before everything shut down.

MARCH

We watched the world unravel, and more importantly, the stock market crash hard.

It looked like an opportunity to us, so we spent the month understanding what the market was, how it worked and how we could take advantage of it.

APRIL

Flynn and I (nervously!) put our first dollars into the stock market together.

We deposited $1059.40 into our TFSA and bought 2 bank stocks - Bank of Nova Scotia (BNS.TO) and CIBC (CM.TO).

This felt terrifying and we spent the following weeks watching our money fluctuate up and down.

Over the next few months, we bought into almost 30 individual stocks primarily focussed on growth with a small quarterly dividend payment.

Our goal was to ride the market recovery after the covid crash and make enough money to buy another rental property.

MAY

Our very first month of dividends rolled in from purchasing stocks the previous month.

We made $22.29.

It was the first time we saw what true passive income was all about and we were hooked.

If we could make this work, we wouldn’t have to pursue our rental property business and could instead cash flow monthly without all of the headache of finding tenants, collecting rent, maintenance and all of the work that comes with being a landlord.

The light bulb had turned on.

Our 2020 Investments:

We made a small goal to contribute $1000 per month from our income to our stock portfolio.

After seeing it work, in September we ramped up our savings to $2,000 per month.

I remember this feeling like A LOT of money at the time as neither of us were making crazy money.

I was grossing around $100k in my business and Flynn was making about $60,000 per year as a mechanic.

Including a reallocation of a $6,631 mutual fund, we invested $24,220 our first year of investing.

We finished the year celebrating approximately $8,000 in capital gains from this 2020 investment and rode the rising market all the way into March 2021.

The plan was in motion.

2021: Big Money Moves

This was the year we began tracking our numbers more closely. We started the year with a portfolio value of $68,081.31.

MARCH

Part 1: We first discovered investing for monthly cash flow instead of growth on a YouTube video.

We spent the month learning everything we could, sold off 90% of our individual stocks with the exception of some of the single bank stocks, and took massive action as we flipped our entire strategy to cash flow & income investing.

We purchase stocks and funds with the intent of living off of the dividend income from those funds by the time we were 40.

This marked the birth of our Free at 40 goal as two 32 year olds who believed we could do the impossible.

Part 2: We decided to put our house up for sale and invest the profit into this cashflow style of investing. It sold in 5 days for $775,000.

You can read the math behind this decision in this article: Why We Sold Our Home to Rent.

JULY

We received the net proceeds of the house sale into our bank account, totalling $465,394.52.

We topped up our emergency funds, paid off the $31,233.42 loan from my parents for the rental property and invested $408,759.51 into cash flowing funds.

We also moved into our beautiful 4 bedroom rental home.

SEPTEMBER

Surprise! We found out we were pregnant with baby #2.

We set the goal for Flynn to quit his job as a mechanic by the birth of our second baby (read that story here: Have You Run the Numbers?).

Realizing we could make a higher return yearly and not have to deal with tenant turnover, we put our rental property for sale for $345,000 and sold it in two weeks.

NOVEMBER

We received the net proceeds of the rental apartment sale, totalling $100,547.99, and invested most of it.

Our 2021 Investments:

This was a massive year of investing, with a total of $546,461 deposited into our investment broker platform.

We continued to invest in cash flowing assets that paid us monthly.

We tracked our monthly dividends for the 2021 year and received a total of $21,899.66.

As with 2020, we reinvested (compounded) all dividends earned.

You can see on the graph above the two huge jumps from our property investments.

We ended 2021 with approximately $614,141 invested.

2022: Goal Achieved

APRIL

On one of our Sunday morning money dates, we dreamed up this vision of our family travelling 4-6 months every year outside of Canada exploring new cities and warmer climates.

The plan was set in motion: we’d spend 1-2 months in January & February 2024 in Panama, Costa Rica, or some place similar.

JUNE

Flynn’s quit date and the birth of our baby!

JULY

With an average of $5,200/month in dividends, we surpassed our monthly expenses with dividends earned.

We had reached financial independence at 33 years old and work became optional.

AUGUST

Flynn handed in his resignation letter and quit his ten year career as an automotive mechanic. I continued to run my business as a health consultant.

Our 2022 Investments:

During the first half of the year, we continued to add to our portfolio with new money earned from Flynn’s job and my business.

We added no new capital after July 2022.

In 2022, we received $61,414.59 in dividends and compounded them back into our portfolio on a monthly basis.

We ended 2022 with approximately $695,000 invested.

2023: The Year of Compounding

There isn’t much to say about 2023! I like to think of it as the “year of compounding”.

It was pretty boring, financially.

We didn’t add fresh capital, but instead re-invested every dollar we earned and continued to watch it grow.

We earned a total of $66,186.04 in dividends in 2023.

We ended the year with approximately $782,000 invested and had spent the last half of the year excitedly (and nervously) planning for our first long trip out of the country with our two little girls.

Between living on one income and paying for our upcoming trip, we kept our spending pretty streamline.

2024: A Year of Change

JANUARY

Flynn and I took our 1 & 3 year old girls to Panama for 8 weeks and it was such a phenomenal experience.

(Read How Much Did Our 2 Month Trip to Panama Cost? or watch our highlight video here.)

FEBRUARY

After hanging out with our investing friends Adrian & Erica in Panama, we made our second HUGE portfolio switch.

We sold off many of our single sector ETFs (ie: energy or banks) and switched to all in one funds that were multi-sector.

In addition, we sold off the last of our US Dollar funds and invested in their Canadian counterparts.

This created a huge jump in our income and began the streamlining process of our portfolio from over 70 funds down to 30.

JUNE

I began writing The Freedom Diaries!

Just as I was getting started, our landlord decided to sell our house and we were faced with the decision of whether to settle into a new home base or jump into the nomad life.

(Read about it here: This News Shakes Up All Of Our Plans...)

Three days later, the house sold and we made the decision to become nomads.

JULY

Up until this month, we had reinvested nearly 100% of our dividends earned.

This month, we began to live off of the portion generated from our non registered, cash/margin account which equaled approximately $4,300/month.

During this time, I scaled back to one day per week of optional work and stopped marketing my business.

AUGUST

On the last day of the month, we packed our life into a storage locker and said goodbye to our home and jumped into the nomad life!

(Read The Adventure Begins)

SEPTEMBER

We spent the month exploring the Qualicum Beach area of Vancouver Island.

(Read 8 Places to Explore in Qualicum Beach, BC)

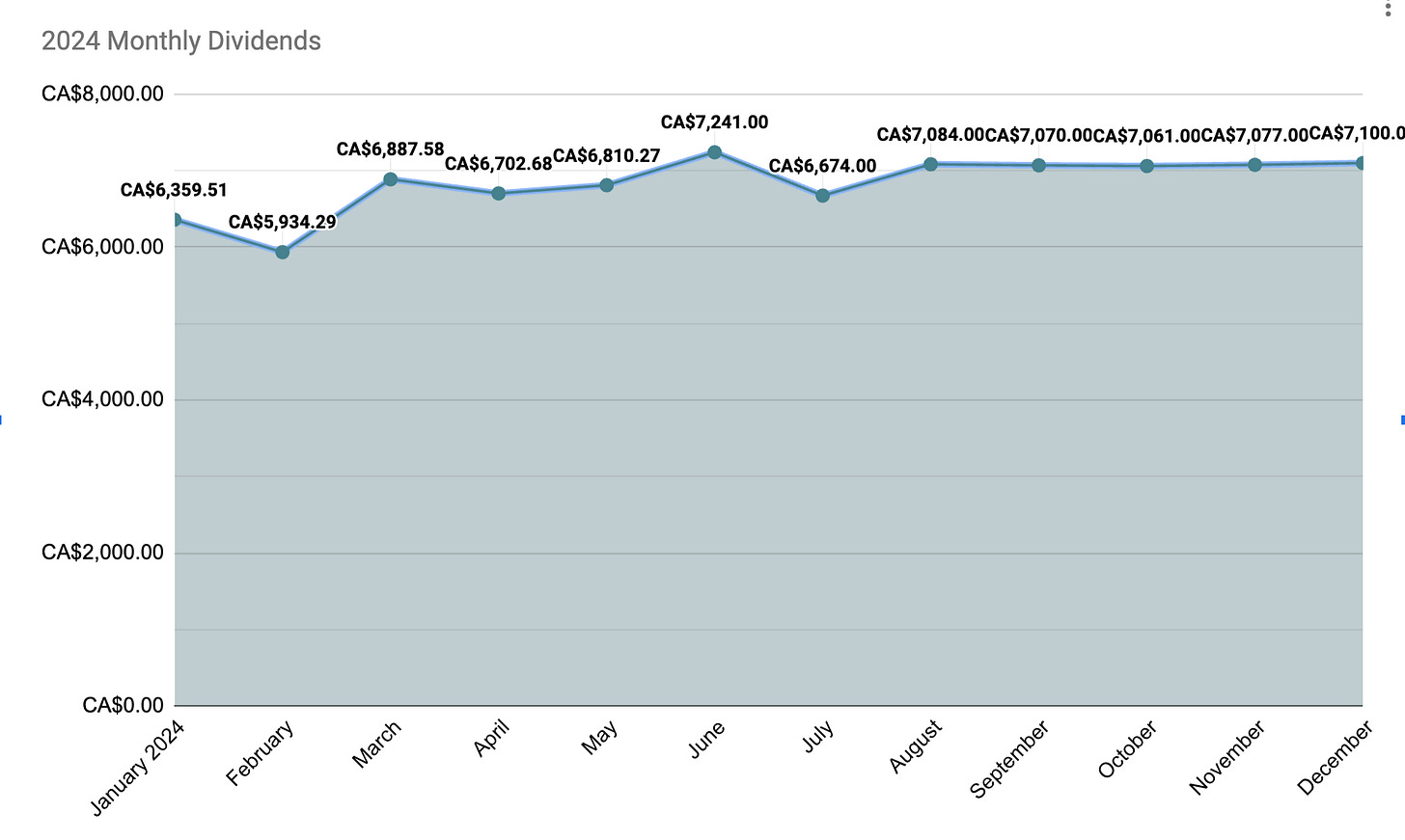

Our 2024 Investments:

We removed approximately $72,000 from our dividend earning portfolio to move into an alternative investment outside of the stock market.

Because of the changes made in February 2024, we saw a jump in monthly income.

We diligently reinvested dividends for the first half of the year and began living off of 2/3 of them by July.

With all the changes taking place, no new capital was added.

By the end of the year, we collected $82,001 in dividends.

From the chart below, you can see when we stopped reinvesting as the growth of our monthly income levelled off right around $7,100/month.

This also marks the reallocation of our money to travel instead of building our portfolio.

We ended the year with a portfolio value of $754,232.71.

2025: A Blank Canvas

JANUARY-APRIL

It is mid February at the time of writing and we are on a 13 week trip to the Dominican Republic.

Flynn is currently retired and I am working 2-3 hours per week, so pretty much retired!

I just celebrated my 36th birthday and have had a wonderful time writing this and looking back on the Free at 40 goal that we smashed right through.

While we can’t know what the future will bring, I’d love to give you an update on where things sit today.

This year, we are predicted to earn between $94,337.52 (if we live off of every dollar of our dividends) and $100,103.96 (if we reinvested every penny, according to our compound interest calculator).

We are currently grossing $7,861.48/month in dividends, or $94,337.52 annually.

That’s $258.46 per day, all year long.

$10.77/hour around the clock.

Completely passive.

We are play-working a couple of hours per week and are travelling 6-7 months per year with our two little girls.

Let’s just say, life looks wildly different than how we envisioned it while sitting at that Tony Robbins event back in 2017.

Here is a look at the lifetime dividends earned since we began tracking January 2021.

To date, we have received $243,566.62 in completely passive cash flow.

We may even become cash millionaires by the end of 2025.

It’s wild.

Final Thoughts

I’ve had a repetitive thought as I’ve experienced the evolution of this journey: there is no way I could have predicted the path to get here.

I originally thought it would be through real estate rentals.

Or my business.

Never did I imagine this path.

What it has taught me is to let go of needing to know the “how”.

How will we get there?

How will we get the money?

How do we invest?

How will it all work?

There is a quiet power in not knowing how it will work out.

Without knowing “how”, you have to stand at the door of possibility with a million possible outcomes being available to you.

By letting go of the “how”, those possibilities become yours to grab.

Never be confined to one path.

Because it’s the road that you least expect that will walk you straight into your dreams.

Tanessa

P.S. If you’re craving cash flow now…

You’ll love our 5-day challenge: The Cash Flow Investor.

It’s designed to help you build your own income-producing portfolio & make your first $100 in monthly dividend income, without waiting decades.

Whether you're brand new or already investing, this will meet you where you're at.

Well done and congrats! A sensitive question: how taxes affected the process?

So inspiring! I never thought about the strategy of looking for funds that generate such high consistent income. What an insight! Hopefully my family can apply this thinking. Thank you!