Our Money Dates started in April 2021.

At the time, we had a 14 month old baby and she would peacefully sleep until 8:30 am.

At 6am every Sunday, my husband and I would curl up on the couch with our laptops, a calculator and a google spreadsheet and have a money date.

These mornings became the cornerstone of our finances and our relationship.

Flynn and I are in lockstep on our money because we still devote time weekly to making these dates happen.

We are completely on the same page because many of our biggest money moves, life pivots and plans were created on these mornings.

I’d love to tell you all about them.

What Is A Money Date?

A money date is dedicated time between you and your partner (or just you if you’re solo!) where you sit down and spend time talking about money.

Here are some of the things we talk about on our money dates:

How much is coming in - What did my business earn last month? This year so far? What has Flynn made from his job/business? What other sources of income do we have this month?

How much is going out - What are we spending our money on every month? What are we overspending on? Where do we need to allocate more money to? Do we need to update the budget?

What we’re doing with it - Where is our money invested? What’s happening with the market? Is our portfolio diversified and balanced? Are the funds we are invested in paying what we anticipated?

What we want to do with it - Is our investment portfolio due for a rebalancing? How are we investing/reinvesting new money this month? What new funds are we considering adding to our portfolio? Are there any big moves we need to make? Are we using our dividends to pay for anything this month or are we reinvesting?

How much we have - How did our portfolio perform last month? What is our current net worth as of this month? What is our monthly cash dividend? What is our portfolio valued at? How much money does our “float fund” or “sink fund” that we pay our bills from have in it? Do we need to pull money from the corporation?

How much we want to have - What is our next financial milestone? What monthly dividend target do we want to hit next? How much will we need to invest to hit it? Where is that money coming from? Is there another way of getting there without making extra money? What can we optimize?

How we’re going to earn it - How can we boost business revenue this month? How much do we need to live the style of life we want to live? What is the plan to bring this money in? What is the fastest way to increase revenue that does not take away our freedom?

The skills we need to learn - What do we need to get a better understanding on? What needs more research? What skills can I hone that would accelerate our ability to make money? What videos should we watch this week? What courses can we join/review/catch up on?

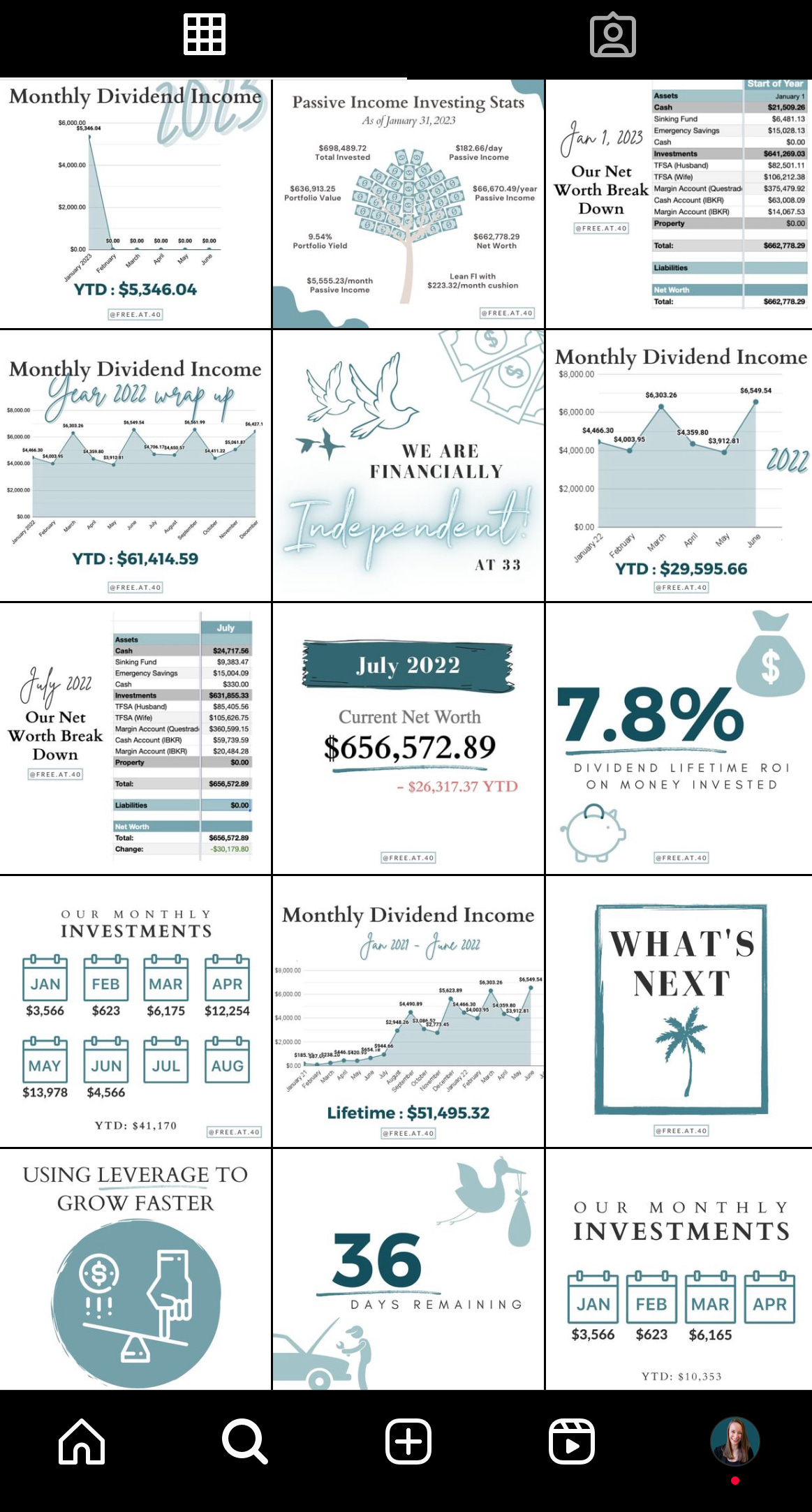

We even documented our entire process on an anonymous Instagram account that tracked our money growth month by month.

We updated this account consistently for two years (and grew a small following!) but discontinued in May of 2023 as we had two kids and we wanted to spend more time on the planning than on Canva creating pretty graphics.

Why Do A Money Date?

The most magical moments can happen when you are regularly focussing on your dreams.

It was Fall of 2021 during a Sunday morning money date when one of my favorite moments happened.

We were sitting on the couch, working our budget.

“If we increased our income by XYZ, then we could ABC!”

”What if we did this? Or that?”

Then this idea hit me.

I scrolled over to Flynn’s income box on our monthly budget Google Sheet. I clicked his income that averaged $5000/month take home.

I hit delete.

I stared in shock at our budget - with my take home business income and our incoming dividends, our income outpaced our expenses…

…WITHOUT his income.

What if Flynn quit his job to stay home with me and the kids? He could watch them grow up, be there for first steps, first words and first moments?

So we set the goal. We were newly pregnant with baby #2 and on her birth, Flynn would quit his full time job to come home.

And in June 2022, he did.

That moment would have never happened if we hadn’t been committed to our weekly money date.

You can’t make decisions without data.

Money dates open clear lines of communication and allow you to see what’s really going on with your money.

Money doesn’t have feelings, but it does need a strategy.

Whether you’re saving to retire early, go on an amazing vacation or splurge on something you’ve wanted forever, regular money dates are an excellent way to pave the path.

…But What About My Partner?

If you’re running your finances solo, you call the shots.

Working with a partner? That’s where these money dates become more important than ever.

“How can I get my partner on board? They don’t get the vision.”

Our answer? You have to build it with them if you want them to be a part of it.

In our experience, fear around money and investments come from a lack of understanding.

This is a truth I live by: A confused mind says NO.

Not getting the buy in you’d love from your partner? What are the chances that they just don’t understand how investing works? What do you mean when you say ‘dividend’? How does it all work out? What are the moving parts? What changes for them?

I’ll do another post on conversations with partners, but this will open the door to some of those conversations.

Final Thoughts

Our life would not have been possible without a regular commitment to dating our money and each other.

Keep it simple. Start with one hour per week where you can speak about money, uninterrupted.

Not ready to haul out a laptop and crunch numbers?

Cool, go on a money walk and just get the conversation going.

Keep it fun, keep it light.

Keep chasing freedom.

Tanessa