The DeFi Report: Our Plan to Scale Our Cash Flow Faster

We're exploring the crypto space - here's where we are starting.

Ping.[New incoming message]

MESSAGE / March 19: Check this out. Watch until the end. Re: Crypto apps.

Attached was a clip of a news report of an older man who had made a few wrong clicks, trusted someone on the internet and got scammed for $1,700 in crypto.

Yeah, but that wasn’t what we were doing.

And I get it. 5 months ago, I would have said the same thing.

So I’m starting a new mini series called The Defi Report to share everything we are learning in the crypto space.

Now I want to be really clear - I’m not selling you a shady investment scam. I’m not advising you do what we do. I’m not going to teach you how to do it. I’m not even recommending you check it out.

My Freedom Diaries are about sharing our journey and what WE are doing while being as transparent as possible.

So if you are all for challenging the status quo and learning about something new, watch for these DeFi Reports that I will update periodically.

Why Crypto?

While we were in Panama, Flynn & I asked ourselves The Quantum Leap Question: What don’t we know about yet that is going to change everything?

I have a long time friend who has been in the crypto space for a couple of years and created a super successful membership on how to view DeFi as a business. This was our first introduction to the space.

But let’s back up - what on earth was DeFi?

I didn’t even know how to pronounce it. Deaf-Ee? Dee-Fee?

DeFi (Dee-Fye) is short for decentralized finance. But to define it, let’s understand what Centralized Finance is first.

In traditional centralized finance, like the banks, there is always a big company or group of people in charge. (ie: Bank of Montreal, JP Morgan, Royal Bank of Canada, Bank of America).

In DeFi, everything runs on its own using special computer programs called smart contracts.

People can borrow, lend, and trade money or other assets without needing a bank or a big company to approve it. (Ever tried to take $50k out of the bank and it takes a week and a small interrogation?)

These rules are public and executed automatically by computers so everyone can trust the rules will be followed.

So why crypto? Because it gives us back full control over our own money, what we do with it and what we earn.

DeFi As a Business

For the past 5 months, we have practically been learning another language and have fully immersed ourselves in learning this new space.

We still feel like newbies, there is so much to learn.

But I’m going to try and break down in the simplest way possible what we are doing with our money.

The strategy we are developing is in becoming a market maker, or, a liquidity provider.

(There are many strategies in the DeFi space, this is the one we are learning first.)

To understand it, I want you to pretend you have $500 Canadian dollars in your hand.

You walk into a traditional bank and tell them you’d like to convert it to US Dollars.

They say, “Sure”, and give you US dollars.

But they also take their fee for this service, 2.5% to be exact.

On your $500, you’ll pay them $12.50 for this service to trade your CAD dollars to USD dollars.

$12.50!

But in DeFi, there is no bank to go into.

Instead, people just like you and me act as “liquidity providers” and provide this service to other people who want to change their money from one cryptocurrency to another at MUCH lower rates.

Like for 0.01%-0.3% per transaction.

And instead of the bank making billions per year off its users, real people just like me and you do. And it adds up fast.

As a liquidity provider (what we are learning to do!), you add your money to a pool and get paid every time someone exchanges their currencies.

We get a small fee for this providing service.

Wild, right?

Here’s where it gets even crazier.

It’s NORMAL (and even conservative) in the DeFi space to earn 70%+ on your money yearly as a liquidity provider.

🤯🤯🤯

This is what we are learning to do.

But Hear Me Out

Now, this is not a silver bullet type of thing.

What I don’t want is for you to see dollar signs in your eyes and jump in blindly.

Crypto is extremely volatile. Market movements of 10-20% per day, 40-60% in a month.

It would make even the most seasoned investor start to squirm.

But what we have learned is that understanding it is key.

That is why we’ve dedicated HUNDREDS of hours in the last 5 months to immerse ourself in this arena.

We have already made mistakes and paid “market tuition”, aka money you lose for not knowing what you are doing, to the tune of $3,000.

Here is how we are approaching it: We put $22,000 CAD in over March and April.

We pretend that money does not exist and if it went to zero (which is unlikely), we would have been okay losing that. This lets us make non-emotional decisions.

Flynn and I also have seen $10,000-$20,000 daily swings in our traditional investment portfolio, so it didn’t scare us seeing massive swings.

DeFi requires a strong mindset.

If you have never managed your own investments before (and having an investment advisor or the person at your bank do it doesn’t count), you may want to consider starting there first.

My thoughts right now? Get your “sea legs” first and understand how money works.

Because if you’re like Flynn and I, we ALWAYS invest at the wrong time.

Seriously. We invested over $400k in the summer of 2021 and then watched the market go through a recession and decline. We’re still down $60k as some sectors (finance and real estate) have not recovered yet.

We did that with crypto too. We dumped our cash into DeFi in March and it was a high point in the market - hence why we’re down $3,000 right now.

(Also, some of that loss comes from making newbie moves. We’re learning.)

So This Is The DeFi Report

I’m going to be sharing what we’re doing, our wins and our losses in the DeFi space.

Last week, we made another big investment in our education and are going to take this seriously.

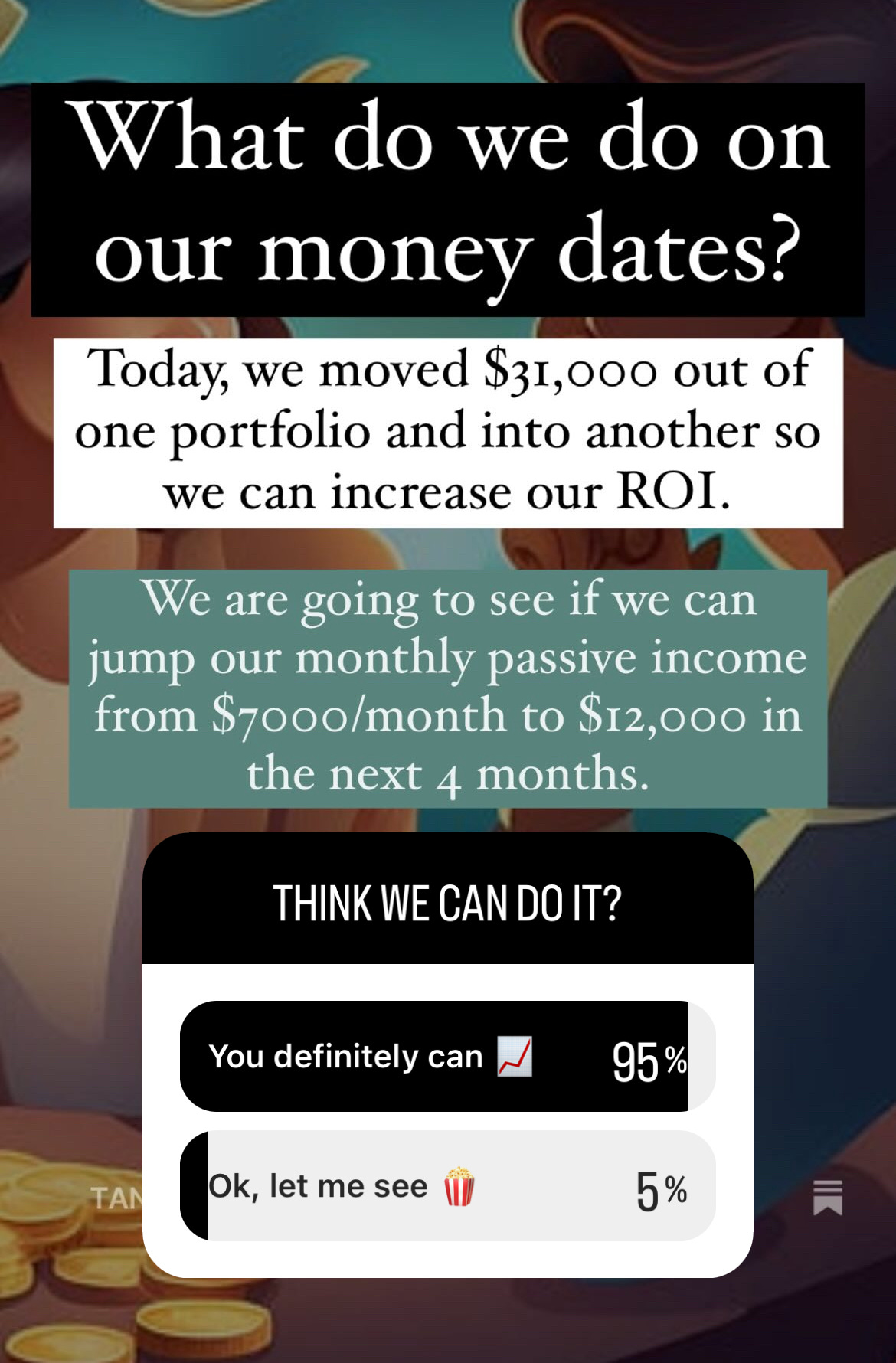

We’ve even set a wild goal to jump our monthly income by $5,000/month in the next four months. Think we can do it? (95% of my Instagram audience seems to think we can!)

In my future DeFi Reports, I’ll be sharing numbers and screenshots so you can see us figure it out, one step at a time.

I’m also doing an interview for my podcast, Becoming Limitless, with my friend who is teaching us everything. I’ll share it here when it’s live.

I only have 2 hesitations in sharing DeFi and I want you to hear them:

There are A TON of scammers in the crypto space looking for gullible targets. Please don’t see the high potential returns, rush to get in and fall for the scammers. Use your common sense.

I really don’t want you to put me in that category. This DeFi report is NOT designed to be a lead in to selling you on crypto or convincing you to do it.

This is just my experience, sharing what’s going on and what we are learning.

If you don’t care for DeFi, no worries! We can still be friends 😉 Not all my content will be DeFi related.

I just wanted you to understand what it is incase you see that word in my other blogs.

Final Thoughts

We’re about ready to double down on our initial investment.

Are we nervous? Yup.

Do we have a solid support system in place as we learn this? Also yup.

If it fails, at least I documented the journey and learned.

If we win, this could be life changing.

I’m excited to share this.

Let’s go.

Tanessa